Is your bank manager a “goodie” or a “baddy”?

Who would know right? How can we tell if you’re getting the best deal or if your bank is taking you for a ride.. Let me get through a few simple points about banking and how it should be working in your favour not theirs! Before reading this please don’t think changing banks will be a huge hassle – it will be a task but the end will be worth it. Try to tell your self you are in charge before you go into see your manager . Then before changing check out your other banks offers, sit down with your bank manager and ask them that your looking to change – they might like to keep you on and offer a sweet deal.

Picking the right Bank &/or Bank account.

I cant tell you what I think the best bank is because we all use our accounts and save differently so we all need a different types, some things might be more important to you than me. For example Fly buys points, if you love to add your points up fast for Christmas (or whatever occasion) try banking with BNZ.

A good way to see what you need from your account/bank is to check out your last month or two month worth of statements. Ask yourself these questions – Do you use ATMs a lot? What about your ATM fees per month? Are you taking nothing out of your savings or more than $10 per month? Do you use direct debits? Do you do everything online or do you still go into the bank? This should help you figure out what you’re being charged for and what you can cut down on if anything. You need the least fees & remember all banks are businesses – they hate to loose a customer.

Direct Debits – yay or nay.

This is a hard one, on one hand direct debits can hep you to manage your finances as the money goes in and out without you needing to do anything. On the other hand if you’re short on money one week it can be a struggle even after you have cancelled the debit (let me guess they charge you to cancel it for a week). I personally have one main direct debit which is my rent, I could add my savings in if wanted as they would be my main things I need to have done every week. I personally go on every day after my pay and move things over manually online – I can then lower some payments if I need money on something else sooner ( the power bill coming in well over its regular or that flat tyre on the car).

Online Banking.

I like to think of online banking as my ATM, I never check at ATMs – I would rather tap into my phone or on he computer before I leave home as its cheaper than using another banks ATM (charges around $2.per atm usage)

Savings.

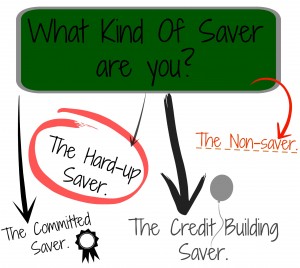

Their are a few different types of savers out there, which one are you?

- The Hard-up Saver. They put money into savings acc then moves it back out to use on something they say they “need” later that week. (eg: food, drinks, extra gas)

- The Non-saver. They don’t have a savings acc (or do but don’t use it) and use up what they have each week.

- The Committed Saver. They have a standard savings acc and don’t take unless emergencies arise. (this is not you, you hard up savers!)

- The Credit Building Saver. They save into one account to pay their credit (cards) at the end of each month. Therefore building credit.

Learning and admitting which saver you are is a task on its own. Here’s a few tips for each type of saver so they can push their savings to new limits.

1. The Hard-up Saver… Talk to your bank manager about opening a smarter savings account where you save for something in the future. Think Holiday, New Car, Wedding Day or even Xmas. You can have accounts now where you cant remove the funds until you reach your savings date. These are great for the hard-up saver because you cant use it unless its before then unless its a true emergency and you have to go through the trouble of visiting your bank manager with proof etc. Now, don’t place a large direct debit into this account each week! That’s the trick, the trick is to save in small amounts $5 to $20 per week is all you need to build a small nest egg without noticing where your money is going. You’ll still have money left for all the thinks you “need”.

2. The Non-saver… Its hard when you see a big pay come in not too go a bit nuts and blow it all on drinks for everyone in the bar I get it! But with a bit of help you can get away with saving every week. The best thing for The Non-saver is to either direct debit a little each week into your savings account and have the account only accessible online. That way you wont withdraw all your savings from an ATM, if you don’t have an savings account and don’t want to open one you can try the old fashioned money in the jar trick. Buy a money jar that cant be opened (can/tin ones are perfect) and place your loose change in there each night before bed, after a month or two you will be amazed and you probably didn’t even miss it!

3. The Committed Saver… Some banks offer higher interest and will give you a special deal if you don’t take out of your savings each month. If you want to be like this saver then please make sure first that you don’t fit The Hard-up Saver profile above or you may find your savings account dry by the time you come to use it for what you saved for.

4. The Credit Building Saver… Ok so your thinking “What??” It’s true, their are a few supersavers out their who build their credit ratings and get great points by doing this, if you want to know more than look below but THIS IS some hard-core saving stuff and is a live by the month type of saving. It’s remembering to buy only what you normally would and checking your savings account at the time to see if you can afford what your about to buy. But this also has serious rewards.

Building Credit? What is it and how do I join up??

It’s not that simple but it kind of is… In basic terms The Credit Building Saver is someone who pays everything they ‘buy’ on weekly basis with their credit card. By doing this they rack up one huge bill and pay it by the end of the month (with their savings-the real cash) before the interest jumps in and stumps them.

The rewards of doing this are the bonus points factors, for example flybys or flyer points (air points). The card you use must have a bonus factor like that so that when you use it so often and pay it off you receive your points and therefore gain free things (flybuys = free stuff, Flyer points = free Holliday) .

The trick is not to spend more than what you would if you did on a weekly basis. First Step: Check account balance each week and remember (or write down) your amount you have to spend that’s how much you can use on yoru card(s). Second Step: Pay off before end of month or before interest hits and/or after savings account gets interest added.

This is also a great way to build up a good/better credit rating. But please be aware this is a very hard savings strategy.

Well that was a lot of mambo-jumbo for one night! Whew! I hope I haven’t fried anyone’s brain too much and you all become better savers in the next few weeks, please check back for more tips, blog posts and lastly hit SUBSCRIBE now or be square and miss out up to you ![]()

Signing Off,